Why Do Companies Merge or Acquire Other Companies?

Mergers and acquisitions (M&A) are actions that combine companies or assets with the goal of driving growth, gaining competitive advantage, increasing market share, or influencing the supply chain.

Key Points:

- Mergers and acquisitions (M&A) are actions that combine companies or assets to foster growth, gain competitive advantage, expand market share, or impact the supply chain.

- A merger occurs when two companies combine, with one ceasing to exist after being absorbed by the other.

- An acquisition happens when one company holds a controlling stake in the target company, which retains its name and legal structure.

Types of Mergers and Acquisitions (M&A)

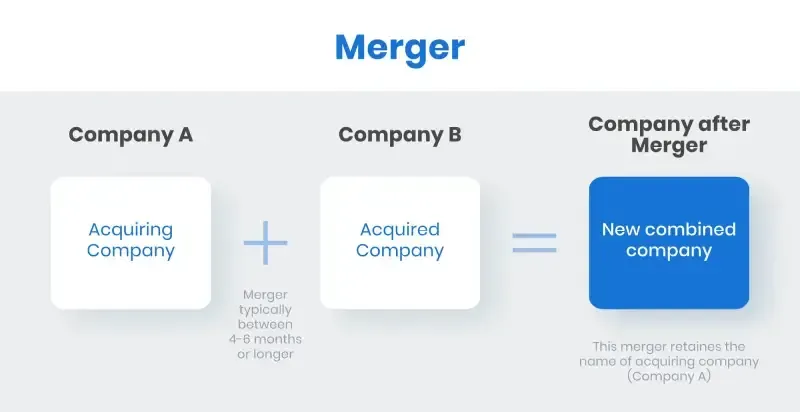

Merger:

A merger occurs when two companies combine, and one of them ceases to exist after being absorbed by the other. The boards of directors of both companies must seek approval from their shareholders.

Acquisition:

An acquisition happens when one company (the acquirer) takes a controlling stake in the target company, while the target continues to operate under its existing name and legal structure. For example, after Amazon acquired Whole Foods in 2017, Whole Foods kept its name and continued business as usual.

Consolidation:

A consolidation results in the creation of an entirely new company. Shareholders of both companies approve the merger and receive shares in the new entity. For example, in 2018, Harris Corp. and L3 Technologies Inc. merged to form L3 Harris Technologies Inc., which became the sixth-largest U.S. defense contractor.

Tender Offer:

A tender offer is a public takeover bid in which the acquiring company directly approaches the shareholders of a publicly traded company, offering to purchase a specified number of shares at a set price within a specific timeframe. The bidder bypasses the management and board of the target company, and the deal may or may not be approved.

Asset Acquisition:

An asset acquisition occurs when one company purchases the assets of another, with shareholder approval from the target company. This often takes place during bankruptcy, where buyers bid for different assets of a liquidating company.

Management Buyout (MBO):

A management buyout occurs when a company’s executives purchase a controlling interest, often to take the company private. However, such transactions require approval from a majority of shareholders.

Reasons for Mergers and Acquisitions (M&A)

Creating Synergy:

By combining operations, overall efficiency often increases, and costs decrease as each company leverages the strengths of the other.

Growth:

Mergers allow companies to expand market share without the slow process of organic growth. For example, a large brewery may acquire a smaller one to increase production and sales.

Strengthening Pricing Power in the Supply Chain:

By acquiring a supplier or distributor, a company can cut out a layer of cost. Specifically, backward integration (acquiring a supplier) helps reduce expenses, while forward integration (acquiring a distributor) often lowers transportation costs.

Eliminating Competition:

Many M&A deals allow acquirers to remove competitors and increase market share. However, such deals often require paying a significant premium to convince target shareholders. Sometimes, shareholders of the acquiring company may react negatively by selling shares, driving down the stock price if they believe the acquirer overpaid.

Conclusion

Mergers and acquisitions (M&A) are vital business strategies that enable companies to expand their scale, strengthen competitiveness, and optimize their value chains. However, not every deal guarantees success, as such processes often involve risks related to corporate culture, governance, and financial costs. Therefore, having a clear strategy, conducting thorough analysis, and ensuring effective post-M&A integration are crucial factors that determine a company’s long-term success.