What Is Financial Synergy? All the Information from A-Z

Discover how financial synergy drives business growth and successful mergers by exploring powerful strategies and real-world examples.

What Is Financial Synergy?

Financial synergy in finance refers to the improved financial performance that occurs when companies merge, collaborate, or acquire one another. In boardrooms across the world, executives pursue this elusive concept, believing it can transform their balance sheets as they hope a business combination can make 1+1=3, a powerful machine whose whole is greater than the individual parts.

In marketing pitches to investors and stakeholders about a new venture, "synergy" (or its plural, "synergies") is often an empty cliché, but it is an important term in financial theory and should not be used merely as a synonym for "efficiency." Synergy can be found through cost savings, revenue increases, or improved capital efficiency when combining business units. By combining resources and capabilities, a merged company can achieve greater combinations and mutually reinforce one another, for example, by reducing the number of employees and other costs previously used to run two or more businesses.

From a strategic perspective, financial synergy is crucial for business growth and competitive positioning. Companies seek to create value through mergers and acquisitions by capitalizing on complementary strengths, expanding market reach, and enhancing innovation. The ultimate goal is to generate higher returns on investment, strengthen financial stability, and maximize shareholder value.

Key Takeaways

- Financial synergy is a key factor in the success of mergers and acquisitions by combining financial strengths.

- The results of seeking synergy can be seen through revenue, costs, and other financial metrics.

- Quantifying financial synergy involves detailed financial metrics and complex analytical methods to accurately estimate the potential benefits.

- Examples like Disney-Pixar and ExxonMobil showcase the transformative impact of financial synergy.

- Other combinations have shown the opposite when promised synergies fail to materialize, leading to mergers that cost shareholders rather than saving them money.

Types of Synergy in Finance

In finance, synergy is the overall benefit that two companies gain when they merge or form strategic alliances. These synergies come in various forms, each enhancing a different aspect of business performance, such as revenue growth, cost reduction, and other financial leverage.

The word synergy is derived from the Greek synergos, with the prefix syn- meaning "together with" and the root word ergon, which is translated differently as "action" or "work." Its use dates back to ancient Greek philosophy (notably Aristotle) and discussions about cooperative actions.

Revenue Synergy

Revenue synergy occurs when strategic business combinations boost sales and expand markets. By merging, companies can leverage each other's customer bases, cross-sell products, and access new markets. This collaboration often leads to better brand recognition, wider distribution channels, and more products, ultimately driving higher revenue growth than the companies could achieve independently.

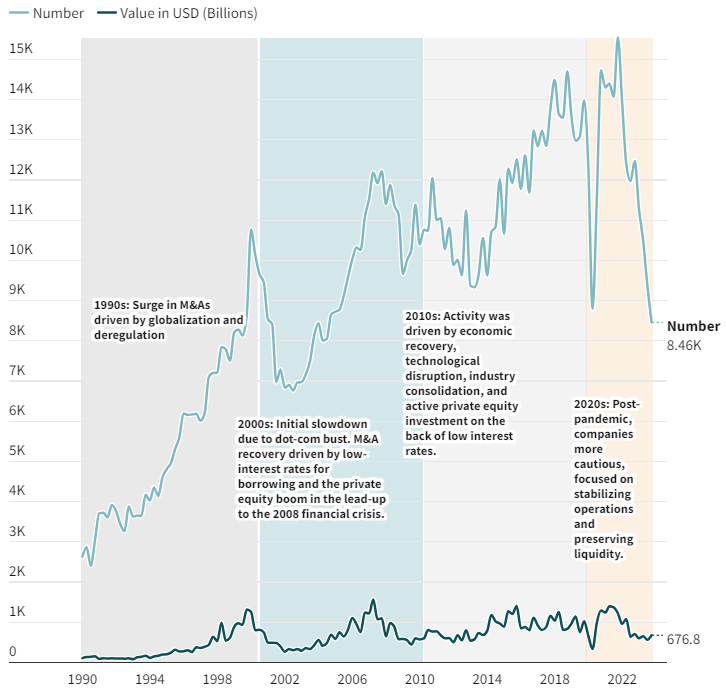

Mergers & Acquisitions Worldwide and the Drive to Find Synergy Since 1990

This chart highlights the volume and value in global M&A, illustrating how companies pursue synergy to improve their competitive advantage, achieve greater efficiency, and drive growth. In recent years, M&A is fueled by digital transformation and a search for financial synergy through cross-border deals.

Cost Synergy

Cost synergy arises from cost cuts (reducing employees and other costs) achieved through mergers and acquisitions. When companies combine, they can streamline operations, eliminate redundant processes, and leverage economies of scale.

This can lead to lower production costs, reduced administrative expenses, and more efficient resource utilization, ultimately increasing profit margins and strengthening the overall financial health of the merged entity.

Financial synergy in mergers and acquisitions (M&A) aims to create a combined entity that outperforms the individual companies. By merging, companies can leverage economies of scale, streamline operations, and increase market share, leading to a greater overall value.

Other Financial Synergies

Other financial synergies can include increased borrowing power and improved financial stability. When companies merge, their combined balance sheet often has more assets and stronger cash flows, making them more attractive to lenders. This can result in lower borrowing costs and access to more favorable financing terms. Additionally, a larger and more financially robust entity can better withstand economic downturns, invest in growth, and provide higher returns to shareholders.

Measuring Financial Synergy

Measuring financial synergy involves analyzing a range of financial metrics to quantify the benefits of a merger or acquisition. One common method used is discounted cash flow (DCF) analysis, which calculates the present value of future cash flows from the combined entity. Comparing the DCF value before and after the merger can reveal the added value created. Additionally, analysts often look at changes in key ratios such as earnings per share (EPS), return on investment, and profit margins to gauge financial improvements.

Another method for quantifying financial synergy is through a comparative analysis of the cost structure and revenue streams before and after the merger. This involves evaluating cost savings from operational efficiencies, economies of scale, and increased purchasing power. Analysts can also track revenue growth from market expansion and product diversification. By using these financial metrics and analyses, companies can gain a clearer understanding of the tangible benefits achieved through their strategic combinations.

When companies with complementary strengths merge, they can be more innovative, enter new markets, and develop new products and services, driving long-term success.

Examples of Financial Synergy

Financial synergy drives growth in mergers and acquisitions by combining resources and expertise. Below, we'll explore two key examples from the past to highlight its transformative impact on businesses.

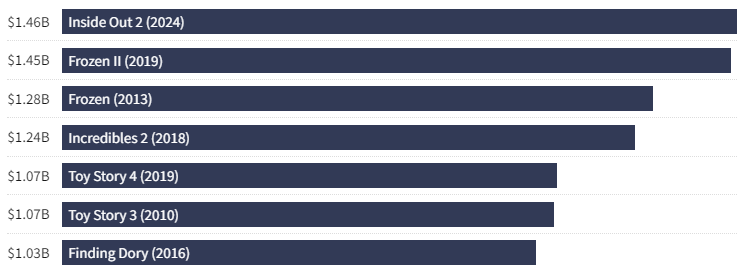

In 2006, The Walt Disney Company acquired Pixar Animation Studios for $7.4 billion, creating a significant synergy in the entertainment industry. This merger allowed Disney to revitalize its animation division by leveraging Pixar's creative talent and digital technology. The collaboration has produced blockbuster films such as "Toy Story 3" and "Frozen," which significantly boosted Disney's revenue and market share. Financial synergy also extended to merchandise and theme parks, further enhancing Disney's famous global presence.

Disney's Highest-Grossing Pixar Films

Since acquiring Pixar Animation Studios for $7.4 billion in 2006, Disney has produced some of the highest-grossing films of all time through its new division. Even the lowest-grossing Pixar films are big revenue generators, such as "Elemental" (2023), which cost an estimated $200 million (before marketing costs) and, as of mid-2024, grossed an estimated $500 million worldwide.

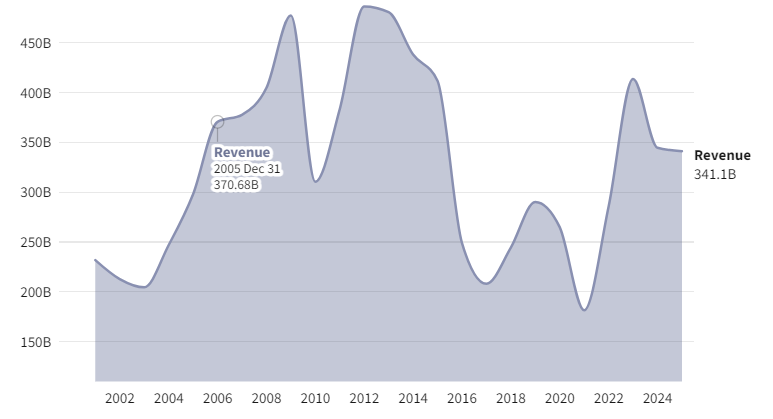

The 1999 merger of Exxon and Mobil, valued at $81 billion, is another classic example of financial synergy. This historic combination created ExxonMobil, the world's largest public oil and gas company. The synergy led to significant cost savings through operational efficiencies and economies of scale. The combination of expertise and resources enabled the company to undertake larger, more complex projects, improving its competitive position and profitability. ExxonMobil's global reach and diversified portfolio have contributed to its sustained growth and shareholder value ever since.

ExxonMobil Corporation Annual Revenue Since 2000

A prime example of seeking synergy through a merger, ExxonMobil has experienced revenue volatility due to the influence of global oil prices, economic conditions, and specific industry challenges. The early 2000s saw big growth fueled by rising oil prices and cost-cutting from the 1999 merger.

Challenges and Risks

Achieving synergy through M&A often faces significant integration challenges. Combining different operational systems, processes, and internet technologies is complex and time-consuming. Misalignment in project timelines or technological incompatibility can lead to inefficiencies and increased costs, eroding the anticipated benefits of the merger.

Another major risk is cultural conflicts between the merged entities. Differences in corporate culture, management styles, and employee expectations can create friction and reduce morale. This discord can hinder collaboration, disrupt productivity, and even lead to the loss of valuable talent, ultimately affecting the combined company's overall performance.

Financial risks also pose a threat to the realization of synergy. Overestimating the financial benefits or underestimating the costs of integration can lead to disappointing outcomes. Additionally, taking on excessive debt to finance the merger can put a strain on the combined entity's financial health, making it vulnerable to economic downturns and limiting its ability to invest in future potential growth opportunities.

Business cultural conflicts often refer to different companies' styles. But it can also allude to companies that hail from very different national cultures, which can derail even the most promising of mergers. For example, the 1998 merger of Daimler-Benz and Chrysler is remembered as a failure, with Daimler's conservative German approach clashing with Chrysler's more liberal American style. These differences led to management conflicts and, ultimately, the merger's dissolution.

Strategies to Achieve Financial Synergy

To achieve financial synergy, companies should conduct in-depth due diligence before any merger, acquisition, or alliance. This includes, among other things, a detailed analysis of financial statements, operational efficiencies, and market position to identify cost-saving opportunities and revenue growth potential. Incorporating robust financial models can help accurately project the impact of synergy. Establishing clear goals and metrics from the outset ensures both parties are aligned and focused on realizing the expected financial benefits.

After the merger or acquisition, effective integration management is critical. Forming specialized integration teams with representatives from both companies can facilitate a smoother transition and quickly identify synergy opportunities. Prioritizing communication and cultural integration helps to minimize disruption and foster a cohesive work environment. Additionally, regular monitoring and reporting on synergy progress can ensure that issues and kinks are addressed promptly, allowing for timely strategic adjustments and maximizing the financial benefits.

When any of the above fails to happen, mergers and acquisitions can quickly fall apart and any potential synergies are lost. Here is a list of the deals that researchers and Wall Street professionals often agree were the most failed ones in recent decades.

The Role of Synergy in Financial Decisions

Financial synergy undoubtedly plays a pivotal role in financial decisions by improving the combined value of merging companies. It can lead to cost savings, increased revenues, and improved cash flow through economies of scale, tax benefits, and better financial planning. By integrating resources and capabilities, businesses can achieve greater efficiency and a competitive advantage, driving long-term growth.

Furthermore, financial synergy allows companies to access new markets and diversify their portfolios, reducing risk and enhancing stability. This strategic alignment fosters innovation and strengthens market position, enabling companies to capitalize on new emerging opportunities. Ultimately, financial synergy contributes to sustainable business expansion, maximizing shareholder value and ensuring resilience in a dynamic economic landscape.

Is financial synergy positive or negative in its impact? Generally, synergy is positive. The idea is that the combined efforts of two or more entities are greater than those entities acting on their own. However, in business terms, while companies may aim for synergy by combining forces, the results are often a lack of synergy, making the effort a wasted one—or worse, a losing one.

Can financial synergy be a primary goal for small and startup businesses? Financial synergy can also benefit small and startup businesses by improving resources and enhancing competitive advantages, though it is often more prominent in larger mergers and acquisitions.

What role does technology play in identifying and achieving financial synergy? Undoubtedly, technology can play a very important role in identifying and achieving financial synergy through sophisticated data analysis, predictive modeling, and seamless integration platforms.

How has the concept of financial synergy evolved with the acceleration of digital transformation in finance? Digital transformation has revolutionized financial synergy by enabling real-time analysis, sophisticated financial modeling, and streamlined processes, leading to the more accurate and rapid realization of synergies.

Conclusion

Financial synergy refers to the potential benefits that companies seek to achieve through mergers, resulting from the combined operations of the merged, acquired, or collaborative entities. These benefits can be seen through improvements in revenue growth, lower costs, tax benefits, and improved financial performance.

More than a synonym for "efficiency," the underlying principle of financial synergy is that the value created by the combined entity is greater than the sum of its parts. This can occur through economies of scale, increased market power, better combined resource allocation, and complementary strengths. For example, a merger between two companies with overlapping departments can minimize redundancies, while a combination of companies with complementary capabilities can lead to improvements in products and services.

In reality, achieving financial synergy is often challenging and not guaranteed. Successful mergers and acquisitions require meticulous planning, seamless integration, and the alignment of corporate cultures. Historical data shows mixed results, with many high-profile mergers failing to deliver the expected synergy due to cultural conflicts, poor integration strategies, and overestimating the benefits. Understanding the complexities and potential pitfalls of financial synergy is crucial for investors when evaluating the impact of proposed business combinations.