What Are Financial Statements? How to Read and Classify Financial Statements

Financial statements reflect a company's business activities and financial performance. Learn how these reports are used by executives, investors, and lenders.

What Are Financial Statements?

Financial statements are reports prepared by a business to detail a company's financial activities and financial health. Financial statements are typically audited by government agencies and accountants to ensure accuracy and for tax, financing, or investment purposes.

The primary financial statements for a for-profit business include the balance sheet, income statement, cash flow statement, and statement of changes in equity. Non-profit organizations use a similar set of financial statements, although they have different names and convey slightly different information.

Key Takeaways

- Financial statements provide a snapshot of a company's financial activities and profitability to governments, investors, executives, and lenders.

- Reports required under Generally Accepted Accounting Principles (GAAP) include the balance sheet, income statement, and cash flow statement.

- A balance sheet provides a snapshot of assets, liabilities, and equity at a specific point in time.

- An income statement chronicles a company's revenues and expenses, including its bottom line known as net income.

- A cash flow statement (CFS) tracks how a company uses cash to pay its debts and fund its operations and investments.

How Financial Statements Work

A business's financial data is used by internal and external parties to analyze its performance and make predictions about the direction of its stock price. One of the most important reliable and audited sources of financial data is the annual report, which contains a company's financial statements.

Financial statements are used by investors, market analysts, and creditors to evaluate a company's financial health and earnings potential. The three main financial statements include the balance sheet, the income statement, and the cash flow statement.

Not all financial statements are prepared under the same accounting rules. The rules used by U.S. companies are called Generally Accepted Accounting Principles (GAAP), while the rules often used by international companies are International Financial Reporting Standards (IFRS). In addition, U.S. government agencies use a different set of financial reporting rules.

Understanding the Balance Sheet

A company's balance sheet provides a snapshot of its assets, liabilities, and equity at a specific point and date in time. The date at the top of the balance sheet indicates when this snapshot was taken; this is often the end of a company's annual reporting period. Here is a breakdown of the items on a balance sheet.

Assets

- Cash and cash equivalents are highly liquid assets, which include Treasury bills and certificates of deposit.

- Accounts receivable are monies owed to the company by its customers for the sale of its products and services.

- Inventory is products that the company is currently holding and intends to sell as part of its business operations. Inventory may include finished goods, work-in-progress products that are not yet complete, or raw materials that are on hand but have not yet been used.

- Prepaid expenses are expenses that are paid in advance of when they are due. These expenses are recorded as an asset because their value has not yet been recognized; if the benefit were not recognized, the company would theoretically be reimbursed.

- Property, plant, and equipment (PPE) are capital assets owned by the company for long-term use. This includes buildings used for manufacturing or heavy machinery used to process raw materials.

- Investments are assets held for speculative future growth. These assets are not used in operations; they are simply held for capital appreciation.

- Brand names, patents, goodwill, and other intangible assets cannot be physically touched but provide an economic (and often long-term) benefit to the company.

Liabilities

- Accounts payable are bills that need to be paid as part of business operations. This includes utility bills, rent bills, and raw material purchase obligations.

- Wages payable are payments that need to be paid to employees for time worked.

- Notes payable are officially recognized debt instruments, which include a payment schedule and the amounts to be paid.

- Dividends payable are dividends that have been declared to be given to shareholders but have not yet been paid.

- Long-term debt can include various obligations, including sinking funds, mortgages, or other loans that are due in a period of more than one year.

- Short-term debt is recorded as a current liability, separate from long-term debt.

Equity

- Equity is the company's total assets less its total liabilities. Equity (also referred to as shareholder's equity) represents the amount of money that would be returned to the shareholders if all assets were liquidated and all debts were paid.

- Retained earnings are a portion of equity; this is the amount of net income that has not been paid out to shareholders as dividends.

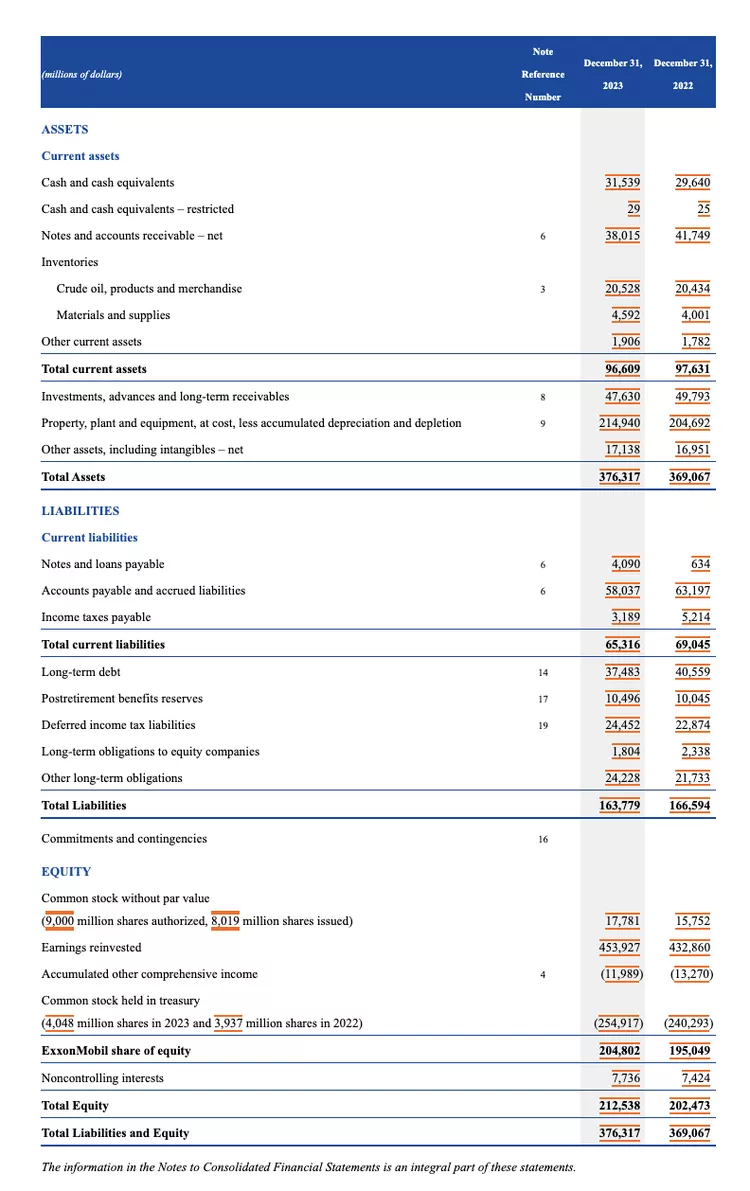

Example of a Balance Sheet Here is a partial balance sheet for ExxonMobil Corporation (XOM) for the 2023 fiscal year, reported on December 31, 2023.

- Total assets were $376.3 billion.

- Total liabilities were $163.8 billion.

- Total equity was $212.5 billion.

- Total liabilities and equity were $376.6 billion, which equals total assets for this period.

Understanding the Income Statement

Unlike the balance sheet, an income statement covers a period of time, which is typically a year or a quarter. An income statement provides an overview of revenue, expenses, net income, and earnings per share for that time period.

The main purpose of an income statement is to communicate details about the profitability and financial results of business operations; however, it can be very effective in showing whether sales or revenue are growing when compared across multiple periods, which provides valuable information about the success of operations to executives and management.

Investors can also see how well a company's management controls costs to determine whether the company's efforts to reduce the cost of sales can increase profitability over time.

Revenue Revenue is broken down into three categories: operating revenue, non-operating revenue, and other income.

- Operating revenue is revenue earned from the sale of the company's products or services. A car manufacturer's operating revenue would be received from the production and sale of cars. Operating revenue is generated from the company's core business activities.

- Non-operating revenue is income earned from non-core business activities. These revenues are outside of the business's main function. Some examples of non-operating revenue include income from:

- Interest earned on cash in the bank

- Renting out property

- Strategic partnerships such as receiving royalties

- Displaying advertisements placed on company property

- Other income is revenue earned from other activities. Other income may include profits from the sale of a long-term asset such as land, a vehicle, or a subsidiary.

Expenses Primary expenses are incurred in the process of earning revenue from the main business operations. Expenses include:

- Cost of goods sold (COGS)

- Selling, general, and administrative (SG&A) expenses

- Depreciation or amortization

- Research and development (R&D). Typical expenses include employee salaries, sales commissions, and utilities like electricity and transportation. Expenses related to secondary activities include interest paid on loans or debt. A loss on the sale of an asset is also recorded as an expense.

Example of an Income Statement

Here is a partial income statement for ExxonMobil (XOM) Corporation for the 2023 fiscal year, reported on December 31, 2023.

- Total revenue was $344.6 billion.

- Total expenses were $291.8 billion.

- Net income or profit was $36.0 billion.

Understanding the Cash Flow Statement

A cash flow statement (CFS) shows how money is earned and spent by a company. A cash flow statement complements the balance sheet and income statement.

A cash flow statement allows investors to understand a company's operations, the sources of its money, and how the money is being spent. A cash flow statement also provides insight into whether the company is in a stable financial position.

A cash flow statement consists of three sections that report on different activities a company uses cash for.

Operating Activities Operating activities in a CFS include any sources and uses of cash from running the business and selling its products or services. Cash from operations includes any changes made in:

- Cash accounts receivable

- Depreciation

- Inventory

- Accounts payable These transactions also include salaries, income tax payments, interest payments, rent, and proceeds from the sale of products or services.

Investing Activities Investing activities include any sources and uses of cash from a company’s investments in its long-term future, which include changes in equipment, assets, or cash-related investments from investing. This includes:

- The purchase or sale of assets

- Loans made to suppliers or received from customers

- Payments related to a merger or acquisition

- The purchase of fixed assets such as property, plant, and equipment (PPE)

Financing Activities Cash from financing activities includes money from investors or banks, as well as money paid to shareholders. Financing activities include:

- Issuing debt

- Issuing equity

- Stock buybacks

- Loans

- Dividends paid

- Debt payments The cash flow statement reconciles the income statement with the balance sheet across the three major business activities.

Example of a Cash Flow Statement Here is a partial cash flow statement for ExxonMobil Corporation for the 2023 fiscal year, reported on December 31, 2023. We can see the three areas of the cash flow statement and their results.

- Operating activities generated a positive cash flow of $55.4 billion.

- Investing activities generated a negative cash flow of -$19.3 billion for the period. Additions to property, plant, and equipment accounted for the majority of the negative cash flow, meaning the company was investing in new fixed assets.

- Financing activities generated a negative cash flow of -$34.3 billion for the period. Dividends paid to shareholders and the repurchase of common stock accounted for the majority of the negative cash flows.

Understanding the Statement of Changes in Equity

The statement of changes in equity tracks total equity over time. This information links back to the balance sheet for the same period; the ending balance in the statement of changes in equity is equal to the total equity reported on the balance sheet. Investors use this information to understand a company's profitability and its stock.

The formula for the change in equity will differ between companies; generally, there are a few components:

- Beginning Capital: This is the ending capital of the previous period rolled into the beginning of the next.

- (+) Net Income: This is the amount of income a company earns for a given period. The income from operations is automatically recognized as equity in the company, and this income rolls into retained earnings at the end of the year.

- (-) Dividends: This is the amount of money paid to shareholders from profits. Instead of keeping all of the company's earnings, a company may choose to distribute a portion of the earnings to investors.

- (+/-) Other Comprehensive Income: This is the period-over-period change in other comprehensive income (OCI). Depending on the transactions, this figure can be an increase or a decrease from equity. In ExxonMobil's statement of changes in equity, the company also accounts for activity for buybacks, liquidations, stock award allocations, and other financial activities. This information is useful to analyze how much money is being retained by the company for future growth as opposed to being distributed externally.

Understanding the Comprehensive Income Statement

A less commonly used financial statement, the comprehensive income statement summarizes standard net income while also incorporating changes in other comprehensive income (OCI). Other comprehensive income includes all gains and losses that have not been recognized on the income statement.

This financial statement shows the total change in a company's earnings, including gains and losses that have not been recognized under accounting rules. Investors and lenders may use this information to get a more detailed and holistic picture of a company’s financial health.

Examples of transactions that are reported on a comprehensive income statement include:

- Net income (from the income statement)

- Unrealized gains or losses from debt securities

- Unrealized gains or losses from derivative instruments

- Unrealized translation adjustments due to foreign currencies

- Unrealized gains or losses from pension plans In the example below, ExxonMobil had over $1 billion of income that was not recognized. Instead of reporting only $36 billion of net income, ExxonMobil reports $37.3 billion of total comprehensive income when factoring in other comprehensive income.

Financial Statements for Non-Profit Organizations

Non-profit organizations chronicle financial transactions through a similar set of financial statements. However, non-profits do not have shareholders and do not distribute profits. Therefore, they use different financial statements to report on their activities, income, and expenses.

These financial statements are used by:

- Donors, to assess a non-profit organization’s operations before making a donation

- Internally or by auditors, to ensure that funds raised by a non-profit organization are being used properly

- Government agencies, to ensure that a non-profit organization is in full compliance with legal and tax requirements

Statement of Financial Position This is the equivalent of a for-profit entity’s balance sheet. The biggest difference is that non-profits do not have equity. Any excess balance after all assets have been liquidated and liabilities have been paid will be referred to as "net assets."

Statement of Activities This is the equivalent of a for-profit entity’s income statement. This statement tracks changes in activities over time, which includes a reporting of donations, grants, event revenues, and costs to run everything.

Statement of Functional Expenses This statement is unique to non-profit organizations. A statement of functional expenses reports expenses by the entity’s function (which is typically broken down into administrative, program, or fundraising costs). This information is distributed to the public to explain the percentage of company-wide spending that is directly related to the non-profit’s mission.

Statement of Cash Flows This is the equivalent of a for-profit entity’s cash flow statement. While the accounts listed may differ due to the different nature of a non-profit organization, this statement is still broken down into operating, investing, and financing activities.

Limitations of Financial Statements

While financial statements provide a lot of information about a company, they also have limitations. The reports are often interpreted differently, so investors often draw different conclusions about a company's financial performance.

For example, some investors may want to see stock buybacks, while others may want to see that money invested into long-term assets. A company’s debt level may be acceptable to one investor, while another investor may have concerns about the company’s level of debt.

When analyzing financial statements, it is important to compare multiple periods to identify any trends and to compare the company's results against competitors in the same industry.

Finally, financial statements are only as reliable as the information that is put into them. All too often, it has been documented that fraudulent financial activity or poor controls have led to inaccurate financial statements that are intended to deceive the user. Even when analyzing audited financial statements, a user still needs to place faith in the validity of the report and the numbers displayed.

What are the common types of financial statements? The three primary types of financial statements are the balance sheet, income statement, and cash flow statement. The three statements together show a business's assets and liabilities, its revenues and expenses, and its cash flows from its business, investing, and financing activities.

What are the benefits of financial statements? Financial statements show how a business is being run. They provide insight into how the business generates revenue, how much revenue it makes, what its business expenses are, how efficiently cash is being managed, and what its assets and liabilities are. Financial statements show whether a company is being well- or poorly managed.

How should financial statements be read? Financial statements are read in a variety of ways. First, financial statements can be compared to previous periods to get a better understanding of changes over time. Financial statements can also be compared between competitors in the same industry to see the differences in their business operations and profitability. By comparing financial statements to other companies, analysts can get a clearer view of which companies are performing best and which are lagging behind the rest of the industry.

What is GAAP? Generally Accepted Accounting Principles (GAAP) are the rules that publicly-owned companies in the United States must follow when preparing their financial statements. These are guidelines that explain how to record transactions, when to recognize revenue, and when to recognize expenses. International companies may use a similar but different set of rules called International Financial Reporting Standards (IFRS).

Conclusion

Financial statements are a vehicle for externally assessing a company’s financial performance. The balance sheet reports on the company’s financial health through its liquidity and solvency, while the income statement reports on profitability. The cash flow statement ties the two together by tracking the sources and uses of cash. Together, these financial statements provide a holistic overview of a business’s financial condition, which is used by management, investors, governments, and lenders.